Fact File: S&P 500 Sigma Events

Posted by Jason Apollo Voss on Aug 27, 2012 in Best of the Blog, Blog | 0 commentsA seemingly endless battle is waged between believers in the efficient market hypothesis, such as Eugene Fama, and believers in behavioral finance, such as Daniel Kahneman. Regardless of your perspective, an analysis of the S&P 500’s history of sigma events provides an interesting field for the battle to be waged.

For example, from 3 January 1950 through 31 July 2012, the average daily return of the S&P 500 was 0.03%, and the standard deviation was 0.98% (source: Yahoo Finance, CFA Institute). These results are remarkably similar to the mean and standard deviation of the normal distribution of 0 and 1, respectively. This suggests that daily returns for the S&P 500 closely approximate the normal distribution, and that returns follow a random walk.

What if you feel that mean and standard deviation are not the only way to describe a probability distribution? Then these data do not tell the entire story. Many researchers have noted anomalies in return data such as extreme positive and negative daily returns — the proverbial “fat” tails that characterize stock market returns.

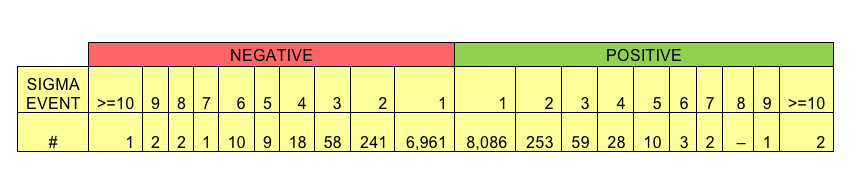

Here is a look at the distribution of the S&P 500’s daily returns categorized by how extremely those returns deviated from the average daily return of 0.03%.

Number of S&P 500 Sigma Events (3 January 1950 – 31 July 2012)

Source: CFA Institute.

As you can see, the overwhelming majority of daily returns fall within one standard deviation, or sigma, from the mean return of 0.03% per day. This is actually a characteristic not discussed as frequently as the stock market’s “fat tails.” Namely, that daily returns are leptokurtic until you reach the tails. Yet, the normal distribution holds that ~68% of returns should occur within one standard deviation of the mean, yet the actual number is a gigantic 95.6%.

Here is the numerical breakdown of the graph above:

Source: CFA Institute.

Market observers have noted that financial markets have become more volatile over time. A look at the number of sigma events by decade makes that clear.

Source: CFA Institute.

For example, the number of normal trading days — as measured by the percentage of trading days that are a <1 sigma event — is sharply lower since the 2000s, with the decade of the 2000s having 1 sigma trading days only 89.54% of time, as compared to the average of 95.56% and the peak of 98.61% in the 1950s. That said, the most “normal” decade, as measured by the decade with the smallest deviations from the average, was a recent decade, the 1990s.

There has also been a doubling of two sigma events, a tripling of three sigma events, and so forth. However, careful scrutiny reveals something extraordinarily interesting: Just two years of daily market activity, 1987 and 2008, account for 56% of all five sigma and above events! In 1987 there were six events that were five sigma and above, and in 2008 there were 18 such occurrences. Wow! These numbers compare to the average number of five sigma and above events per year of 0.68. So, in addition to there being daily return sigma events to be cautious of, there are clearly high sigma years to be wary of as an investor, too.

What about the expected daily occurrence of sigma events? Here is the historical record:

Source: CFA Institute.

What the above chart shows is that there are, on average, 129.2 trading days per 251.62 trading days in a year in which your return is between 0.03% and 1.02%. Similarly, there are, on average, 3.85 days per year where your loss is between −0.98% and −1.99%, or between a one sigma and two sigma loss.

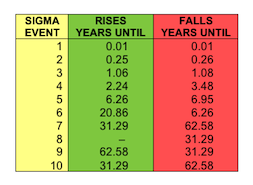

After the two sigma events, it becomes harder to tell what the expected frequency of a sigma event is, so here are the data rescaled by years, instead of days:

Source: CFA Institute.

Here you can see that a seven sigma up day can be expected once every 31.29 years, and a 10 sigma or greater down day can be expected once every 62.58 years.

One famous piece of oft repeated wisdom doled out by the buy-and-hold community is that missing just the top 10 up days results in a significantly lower total return. Consequently you should always stay invested, lest you miss these days. Indeed, when framed this way there is truth to the statement. One dollar invested on 3 January 1950 would have turned into $81.79 on 31 July 2012. Yet, if you had missed those top 10 performing days, you would only have $38.95 instead of $81.79.

But this is only half the story. For what if you were in fact a brilliant market timer, and you were able to miss just the 10 worst-performing days in market history? Your $81.79 would actually be a whopping $214.41. This result is clearly an example of brilliant market timing as investors would have experienced each of the top 10 performing days, yet missed all of the 10 worst trading days.

So what is the result of missing the top 10 and bottom 10 trading days? Investors’ $1 would have grown to $102.94. Because this result is much higher than the $81.79 earned with the buy-and-hold strategy, it does not make sense to justify a buy-and-hold strategy just on the premise that you make more money from employing it instead of market timing.

And just for giggles, what if you had perfect market timing and were only invested on up days? Your $1 investment would have grown to be: $335,288,501,296,558,000,000,000. For those of you not up on your large numbers, that is $335 sextillion (or a trillion trillion).

Last, the largest positive sigma event of all time occurred on 13 October 2008, when the S&P 500 surged upward registering as an 11.82 sigma event. Meanwhile, the largest negative sigma event was the famous 19 October 1987 crash, which was a whopping 20.98 sigma event!

Originally published on CFA Institute’s Enterprising Investor.